The American Dream is quickly fading away as our nation hurtles towards financial collapse. But, the mainstream media stays fixated on the trivial drama of the “debt ceiling,” conveniently ignoring the truth that our nation is already bankrupt.

We discover ourselves trapped in a system the place huge authorities and massive firms are rising stronger each day and exerting an increasing number of affect in each facet of our lives. This insidious partnership siphons huge quantities of wealth into the pockets of a privileged few, whereas the remainder of us battle to make ends meet.

In response to a New York Federal Reserve chance mannequin, the probabilities of the USA falling right into a recession inside the subsequent 12 months have reached a 40-year excessive. The writing is on the wall, and the indicators of impending financial catastrophe encompass us.

- Complete shopper debt has soared to a staggering new excessive, surpassing $31 trillion

- Because the pre-Covid period of 2019, whole indebtedness has skyrocketed by roughly $2.9 trillion.

- International governments and personal buyers maintain practically $7.6 trillion of the debt — roughly 31% of the Treasurys in monetary markets.

A current research performed by Researchers at Brandeis College revealed that over one-third of American households working full-time fail to earn sufficient to cowl their primary wants. In consequence, housing, meals, transportation, medical care, and important family bills stay out of attain for these hardworking Individuals. The state of affairs is especially extreme for low-income households with kids, with greater than two-thirds of full-time staff reporting that they’re now struggling to make ends meet.

In the meantime, bank card debt is poised to surpass $1 trillion for the primary time, additional sinking Individuals into debt slavery with file rates of interest of 25%. Fundamental requirements have gotten more and more unaffordable, pushing numerous folks and households to the brink of economic damage.

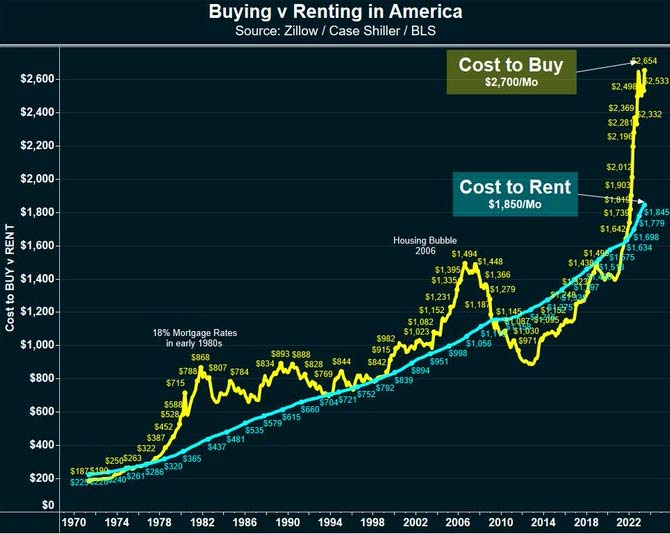

And the price of renting or shopping for a house…

A current survey highlighted the pervasive monetary stress gripping the nation, with roughly 70% of Individuals brazenly admitting to worrying about their private funds. Furthermore, because the onset of the so-called Covid-19 pandemic, 52% of American adults report that their monetary stress has intensified.

Banking System heading in direction of Soften-Down Territory

And within the ever-growing banking disaster, Treasury Secretary Yellen just lately advised financial institution CEOs that additional financial institution mergers “could also be vital.” This disaster is just not solely accelerating the motion of deposits but additionally consolidating the banking sector. Over the previous century, the full variety of banks within the US has fallen by 90% to solely 4,100 banks nationwide – and lots of of these are in main danger of collapse. It’s fairly clear what they’re doing, fairly quickly a handful of highly effective few banks will wield management over nearly all US deposits.

- The Banking Collapse Of 2023 Is LARGER Than The Banking Collapse Of 2008

- In response to the NFIB Small Enterprise Optimism Index, small companies are grappling with historic inflation, power labor shortages, and a bleak financial outlook. As many as 45 p.c of small enterprise homeowners consider that the economic system will proceed to deteriorate, making it tough for them to function and keep afloat.

Are you Ready?

Our nation stands on the precipice of financial collapse, with our livelihoods hanging within the steadiness. The American Dream is fading into obscurity because the forces of greed tighten their grip.

We advise studying our article on Making ready for an Financial Collapse. We speak concerning the historical past of financial collapses, record the steps you’ll want to take, and discuss what is going to most certainly occur when the banking system goes down. You may learn the article right here.

Be Ready to Feed Your self when the Collapse Hits!

Grocery Choices that ship proper to your Residence: