Is Industrial Actual Property the newest canary within the financial coal mine?

In line with current financial information, gross sales of economic mortgage bonds have fallen off a cliff, plummeting about 85% year-over-year as business actual property buyers are bracing for what appears like a wave of defaults all through the business actual property business.

In line with a current Bloomberg Information report, the collapse of the American mall business may very well be proper across the nook, and should trigger a wave of economic actual property defaults that extends to workplace areas hit by the work-from-home rip-off.

Final 12 months noticed a ten% drop in business actual property loans — the underlying debt that usually will get repackaged into business mortgage bonds — in comparison with the 12 months earlier than, to $804 million from $891 million, in response to Mortgage Bankers Affiliation information. As well as, the commerce group expects an extra 15% drop in CRE loans in 2023 to $684 million, once more slashing the variety of loans that may be securitized and offered.

In line with Fox Information:

The enormous funding supervisor Brookfield Asset Administration just lately defaulted on a complete of over $750 million in debt for a pair of 52-story towers in Los Angeles, in response to a February securities submitting. Actual-estate agency RXR is in talks with collectors to restructure debt on 61 Broadway, a 34-story tower in Manhattan’s monetary district, in response to folks conversant in the matter. Handing over the constructing to the lender is among the many choices into consideration, these folks mentioned.

In one other signal of misery, a enterprise of an funding supervisor affiliated with Associated Cos. and BentallGreenOak is in comparable debt-restructuring talks over a $150 million warehouse-to-office conversion venture in Lengthy Island Metropolis, N.Y., that hasn’t crammed up as a lot area as anticipated, in response to folks conversant in the matter.

“Default danger has elevated and may very well be extra problematic if charges enhance and the economic system slows,” mentioned Chris Sullivan, chief funding officer at United Nations Federal Credit score Union. “So, I feel a cautious and particularly diligent method is acceptable.”

So What does this imply for you?

For small enterprise house owners, the information is devastating and the trickle impact will finally make it right down to everybody. Thanks largely to a technology of COVID staff who refuse to return to work, small brick-and-mortar companies are in actual bother. In actual fact, in Manhattan, for instance, distant work is costing retailers $12.4 billion a 12 months as staff now not purchase their morning coffees or get their dry-cleaning accomplished within the metropolis.

Are we residing in fantasy land?

he United States faces a default someday this summer season or early fall if Congress doesn’t elevate or droop the debt ceiling, a Washington assume tank warned on Wednesday. However, as we reported late final 12 months, it’s arduous to see how we get out of this catastrophe unscathed. The federal authorities is actually bankrupt and has entered the land of make-believe accounting.

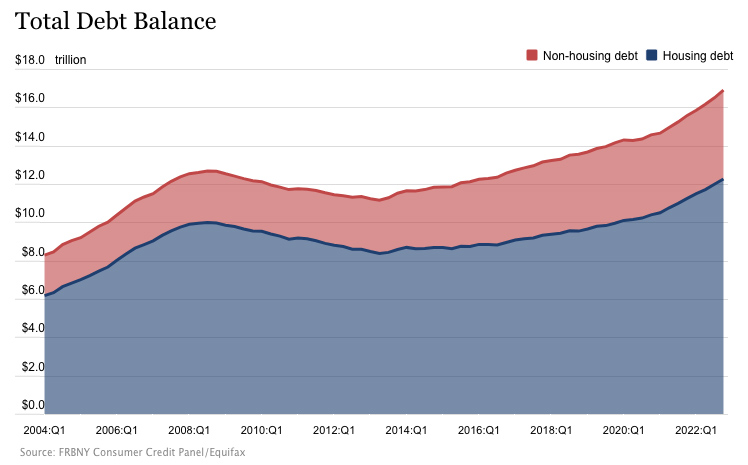

In line with CNBC’s newest ballot, the typical American isn’t doing significantly better than our authorities. In line with the newest New York Fed Family Debt and Credit score report, whole family debt rose by $394 billion within the final quarter of 2022. It was probably the most vital quarter-on-quarter rise in 20 years.

Whole family debt elevated by 8.5% in 2022 and now stands at a document $16.9 trillion. That’s $2.75 trillion larger than it was pre-pandemic.

Bank card balances elevated by one other $61 billion in This fall.

In a current podcast, Peter Schiff mentioned the surge in bank card debt actually evidences the truth that we don’t have a robust labor market.

If the labor market was actually so sturdy, folks’s paychecks can be excessive sufficient that they wouldn’t want to make use of credit score to purchase the issues that they wanted. They may truly afford to purchase stuff with out going deeper into debt, particularly since rates of interest are rising a lot. You’d assume customers can be reluctant to tackle extra debt in a rising fee setting. The one purpose they’re doing it’s as a result of they actually don’t have any alternative.”

Much more troubling, 64% of Individuals say they’re residing paycheck to paycheck. Are you able to think about what will occur when folks notice there isn’t any approach off this sinking ship?

Getting ready for an financial collapse

For those who’re not ready, you’ll want to begin taking steps to guard your self and your loved ones from future troubles.

Keep watch over the markets, and keep watch over the banks.

Earlier than depositing any cash in a financial institution, you’ll want to analysis the monetary soundness of that financial institution. Because the so-called finish of the monetary disaster, when the federal government spent over 700 billion {dollars} to “repair the system,” over 511 banks have failed.

With so many banks nonetheless going below, you actually must surprise how lengthy the FDIC can proceed to pay out on these insured deposits. With banking business belongings sitting at round $22.7 trillion, there may be little purpose to imagine the FDIC can cowl these insured deposits throughout a full-scale collapse.

Whereas many imagine the FDIC protects their cash, the easy reality is, there’s not sufficient cash to guard everybody. If the system collapses, your FDIC-insured account is something however sure.

Understand your {dollars} might turn into nugatory.

Over the past 12 months, our cash has turn into value much less and fewer by the month. From gasoline costs which have greater than doubled within the final couple of years to hovering meals costs and sky-high rates of interest, our greenback is already changing into much less beneficial.

It could be greatest should you severely checked out the potential for an all-out collapse of the system. If this had been to occur, your {dollars} would rapidly turn into nugatory.

It’s essential to begin to take a balanced method to being financially ready for the long run. Whereas investing in your monetary future is necessary, the identical might be mentioned for investing in your skill to outlive future disasters. For those who haven’t began getting ready for financial troubles, now’s the time to noticeably think about stocking as much as survive future monetary issues.

Be Ready to Defend Your self

Investing in long-term consumable items.

This implies stocking up on objects you will have and use sooner or later or stocking objects you’ll be able to barter with in case the system fails. By stocking up on meals, water, survival gear & provides, and bartering items, you’ll have a pleasant stockpile of provides that can make it easier to by way of nearly any catastrophe.

One other upside to investing in consumable items is these items are fully safe from monetary market volatility and can proceed to carry their worth after the collapse. In actual fact, as we’ve seen over the past 12 months, most consumables will most likely skyrocket in worth in a post-collapse world.

Be Ready to Feed Your self when the Collapse Hits!

Grocery Choices that ship proper to your Dwelling:

Study to Be Self-sufficient NOW!

To really be ready, you’ll want to discover ways to be 100% self-sufficient.